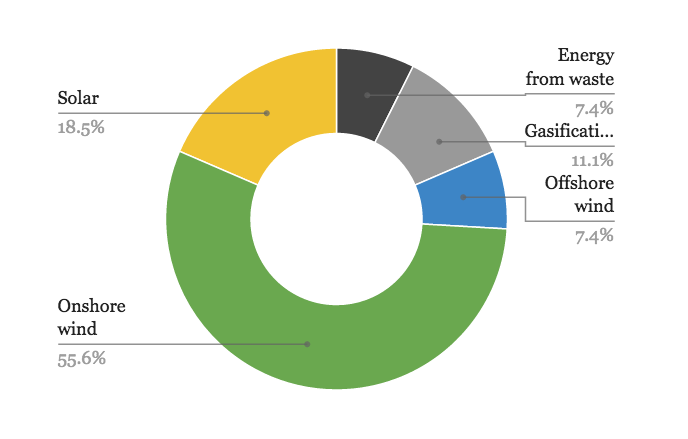

An article in the Telegraph last week highlighted the good news that that economic growth and carbon emissions had “uncoupled”, as the world economy grew 3.3% whilst carbon emissions practically stalled. The UK economy will be further boosted by the growing investment in low-carbon technology, and UK SMEs should aim to grab some of the windfall by implementing alternative sources of power into their businesses where possible. The distribution of UK renewable energy projects is broken down below.

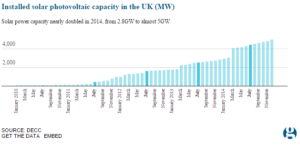

The fast-growing market, which has seen prices drop continually since 2006, has been helped by the improvement in the technology of “green” energy options on offer to customers and businesses in the UK. For instance, even solar energy is proving to be surprisingly successful in the UK, proving to naysayers that had written off the technology as ill-suited to flaky British weather. According to research published in The Guardian, the number of solar installations in the UK almost doubled in 2014.

However, the increase in supply doesn’t always make it cheaper for businesses looking to “go green”. Solar again is the best example: the price of solar photovoltaics (PV) has plunged which has meant the price per watt of electricity is cheaper. However, the government had previously helped install the technology for users of solar powered electricity as well as giving feed-in tariffs, beneficial tax breaks and a handy buy-back of unused power to boot. As these remunerations have been redacted slowly over time, the cost is rising again and SMEs who should be being urged into using green energy are unable to commit financially.

The traditional thinking has been that the affordability of green technology needs to be matched by efficiency that rivals the traditional power sources. However, as efficiency and profitability is enhanced, there is still a need to subsidise the cost and give tax breaks to companies (particularly SMEs) who are using carbon-neutral energy. Avoiding the need to force businesses into over-zealously categorised regulation whilst simultaneously encouraging green energy is something that Amber Rudd and her successors have to prioritise in a bid to ensure that economic growth and carbon emissions stay “uncoupled”. The Telegraph article ends with a stark warning from Bank of England governor Mark Carney that “in the fullness of time, climate change will threaten financial resilience and longer-term prosperity”. The long-term apocalypse that Carney warns us of, namely the inexorable rise of the Earth’s temperatures, can be prevented by near-term solutions that benefit small businesses in the UK.