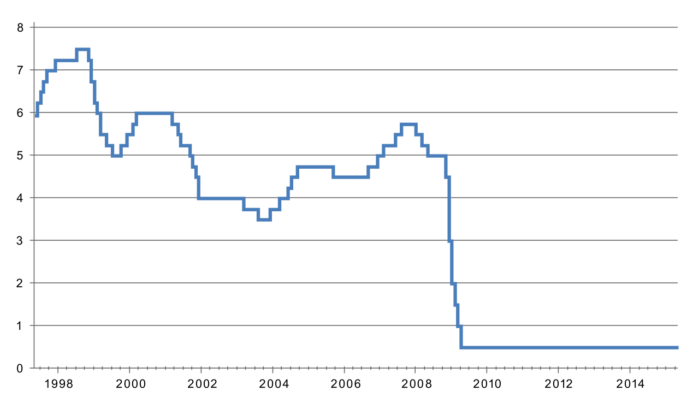

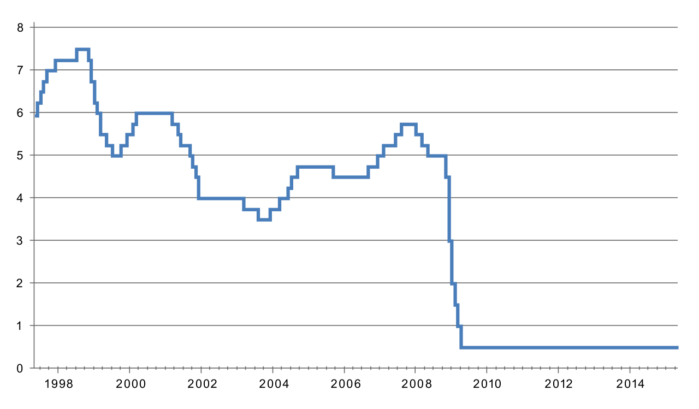

The rate at which the Bank of England is prepared to lend short-term money to financial institutions looks set to fall below its current historic low of 0.5 per cent to 0.25 per cent, a move designed to stimulate the stuttering British economy. However, I would argue that further suppressing the cost of credit will do little to help British businesses battling Brexit uncertainty. Instead this rather negligible Interest Rate reduction will inflate the debt bubble while further punishing pensioners and savers, thereby diminishing waning economic confidence; thus costing companies dear. So what is the MPC’s rationale?

In Money Creation in The Modern Economy - a paper published by the Bank of England in 2014 – Michael McLeay, Amar Radia and Ryland Thomas explain how commercial banks create money via the provision of loans to households and companies. Contrary to economic theory outlined in most textbooks, ‘rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits’ (McLeay et al., p.1, 2014). It is thus the commercial banks (not the Bank of England) who create money. The interest rate – otherwise known as the ‘repo rate’ – acts as the ultimate constraint to commercial bank’s ability to create money as it determines the price and consequently the profitability of lending. By lowering interest rates, the MPC are reducing the price of credit and thus imploring commercial banks to conjure up more money by writing new loans.

The MPC hope that more ‘fountain pen money’ - money created at the stroke of bankers’ pens – might help to sand over the cracks our decision to leave the EU has created. It will not. Rather, it is a vote of no confidence in the UK economy, an economy currently plagued by uncertainty. What’s more, it proves we have learnt little from the 2008 financial crisis. As Mervyn King (2010) suggests, ‘for all the clever innovation in the financial system, its Achilles heel was, and remains, simply the extraordinary – indeed absurd – levels of leverage represented by a heavy reliance on short-term debt.’ Would raising interest rates be such a bad idea?