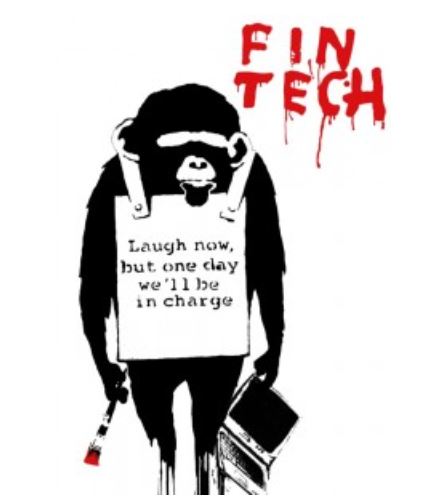

Head of Ernst & Young’s FinTech department, Imran Gulamhuseinwala, recently asked if anyone was actually using FinTech. His question, whilst flippant in tone, raises a couple of issues with both the conceptual definition and the uncertain future of “FinTech”. The word is a rather nasty portmanteau that covers a broad spectrum of businesses that have attracted around $12 billion worth of investment in the last year alone, ranging from crowdlending platforms to payment software and digital currencies, and then the rest. Advocates of the virtues of FinTech bristle at any suggestion of a repeat of the “Dot-Com” bubble, yet you can’t ignore the sense of déjà vu as every man and his dog tries to get a piece of the action, with valuations skyrocketing as a result. Saying that, the drop in venture capital funding for technology businesses at the end of 2015 looks to continue into 2016, although that will be in “number of transactions” rather than a drop in dollars pledged. Companies and sectors that have ridden the FinTech boom may be first to distance and reinvent themselves should the bubble burst. Efficacy is the name of the game for FinTech, and yet there are worries that software is being developed without a clear sight of what it will actually be used for. That will always be the case with technology, and it isn’t to say that there are plenty of instances where financial technology is working very well. It is therefore ludicrous to suggest nobody is actually using it in one form or another.

It is true that reviews of FinTech tend to come from the providers extolling the virtues of the technology, rather than from actual users. However, accountancy firm Ernst & Young produced a survey revealing that 14.3% of UK “digitally active customers” are using FinTech; one in seven isn't a bad ratio for a nascent industry and leaves room for more involvement, which will continue the growth. Whilst there is certainly a supply glut, the payments sector will trim itself down through a simple process of “survival of the fittest”, and in the peer-to-peer lending and crowdfunding spaces there will have to be a more painful process of consolidation. “Democratisation” away from the banks will be through competitors with brands stronger than their balance sheets: more Funding Circle’s and Ratesetter’s, in other words. Standard & Poor’s December report on “The Future of Banking: How FinTech Could Disrupt Bank Ratings” alludes to as much; the big banks will swallow up the smaller fry by saying that “acquisitions will largely be limited to small players, especially in light of strengthened regulatory capital requirements for banks, and gaps in valuation metrics between FinTech players and banks”.

Kadhim Shubber’s response to the S&P report for FTAlphaville raises some good points, but I take issue with the general tone of the article which seems to belittle financial technology as a series of potholes that littler the smooth tarmacked autobahn of banking brilliance. I agree that “the largely unregulated nature of FinTech at some point is likely to come back to bite”; however he doesn’t mention the willingness of FinTech businesses to be regulated. FCA regulation may come sooner rather than later in Peer to Peer Lending, something that the naysayers have also taken umbrage with, arguing that the FCA has forgone its primary role as the strictest of regulators in order to help shift business away from the banks; he may have a point there. Yet FinTech, for Shubber, is a just a nifty opportunity for savvy entrepreneurs to get rich before the banks step in to clean up the competition. FinTech companies wear “big, frightening costumes in an attempt to scare established players into taking you out, at a hefty premium of course.” He cynically portrays the partnership between OnDeck and JP Morgan as an example of a FinTech company “eager to offer up their technologies to large banks who are willing to give them the credibility of a partnership”, instead of a bank seeking to evolve with the times and in doing so putting itself ahead of many of its peers. Read this article published by Reuters for a fairer view of the JP Morgan/On Deck deal than Mr Shubber provides us with. Nobody in their right mind believes the waffle the FinTech will “kill off” the banks; they are already working alongside each other or in partnership and long may it continue.

It is lazy, inaccurate marketing tripe like this that gives people the wrong ideas: Banks and FinTech are already working together and will continue to do so

It is lazy, inaccurate marketing tripe like this that gives people the wrong ideas: Banks and FinTech are already working together and will continue to do so